student loan debt relief tax credit 2020

I didnt receive anything in the mail in December about it like I did last year although everything through USPS is delayed right now. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

IR-2020-11 January 15 2020.

. This benefit originally included in the Coronavirus Aid Relief and Economic Security CARES Act enacted in March 2020 was for calendar year 2020 only but was extended for an additional five years by the Consolidated Appropriations Act 2021 CAA. Can You Get a Refund for Private Student Loan Payments. Complete the Student Loan Debt Relief Tax Credit application.

The Student Loan Debt Relief Tax Credit is a program created under 10 -740 of the Tax -General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor. But six weeks later the president hasnt made a decision as the push has collided with the politics of 40-year-high-inflation in a. The 5250 that employees are permitted to receive tax-free for their education under Sec.

We simplify the refinance process. 7 hours agoThe CFRB says that student loan cancellation of 16 trillion of student debt would increase the inflation rate by between 10 and 50 basis. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were awarded anything.

116-136 and a presidential order government-held federal student loans are in administrative forbearance through the end of 2020 meaning. From July 1 2022 through September 15 2022. All loans currently have a 0 interest rate due to the COVID-19 emergency relief measures.

In 2019 the state awarded nearly 9 million in tax. Ad One form multiple lenders big time savings. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who.

Specifically the act amends Sec. EXECUTIVE SUMMARY. About 43 million federal borrowers still owe a total of.

This bill establishes programs to cancel certain student loan debt and refinance student loans. 127 c 1s definition of educational. WASHINGTON In April President Joe Biden said he was taking a hard look at executive action to forgive federal student loan debt and would have an answer in a couple of weeks.

Recipients of the tax credit must submit proof that they used the tax credit to pay down qualifying student loans. A provision in the March 2021 COVID-19 relief package stipulates that any debt forgiven from Dec. The Biden administration is reportedly considering a plan to forgive 10000 of federal student loan debt per borrower for people earning up to 150000 and married couples filing jointly who earn up to 300000 the Washington said.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor. 0 to check your rates. Ad Apply for Income-Based Student Loan Forgiveness if You Make Between 30k - 200k Per Year.

In response to the pandemic under a provision in the Coronavirus Aid Relief and Economic Security CARES Act PL. 13 2020 meaning any tax refunds seizes or wages garnished during the past year will be returned to the borrowers. Currently owe at least a 5000 outstanding student loan debt balance.

File Maryland State Income Taxes for the 2019 year. Employers can provide up to 5250 annually in tax-free student loan repayment benefits per employee through 2025. Have at least 5000 in outstanding student loan debt remaining during 2019 tax year.

First the bill requires the Department of Education ED to automatically discharge ie repay or cancel up to 50000 of outstanding student loan debt for each qualified borrower. To qualify for the Student Loan Debt Relief Tax Credit you must. Student Loan Debt Relief Act of 2019.

31 2020 to Jan. The COVID-19 pandemic has renewed focus on the student loan debt crisis. WASHINGTON The Internal Revenue Service and Department of the Treasury issued Revenue Procedure 2020-11 PDF that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school.

127 can also be used in 2020 for student loan repayment. 1 2026 will not count as income. Relief is also extended to any creditor.

For loans disbursed after March 12 2020 we use the initial interest rate. Under Maryland law the recipient must submit proof of payment to MHEC showing that the tax credit was used for the purpose of paying down the qualifying student loan debt. Maryland offers the Student Loan Debt Relief Tax Credit for students who have incurred at least 20000 in student loan debt and have a remaining balance of at least 5000.

February 18 2020 842 AM. Incurred at least 20000 in total student loan debt. For this reason we determine the highest interest rate based on each loans interest rate as of March 12 2020 before the relief measures went into effect.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans from an accredited college or university. 2020-11The IRS had earlier provided relief for students from Corinthian College or American Career Institutes Inc. The details of this answer will affect a borrowers daily budget credit score and potentially taxes too according to financial experts.

100 free of fees. CCI or American Career. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and. 1 day agoPresident Joe Biden promised 10000 in student loan forgiveness per borrower while campaigning in 2020 but one expert says its unlikely to happen. STUDENT LOAN DEBT RELIEF TAX CREDIT.

1 The IRS had previously granted relief to those who attended schools owned by Corinthian College Inc. The relief is retroactive to Mar. Federal Student Loan Forgiveness Programs are Available under the 2010 William D Ford Act.

The funds must be applied to the employees own student debt not the debt of the employees spouse or dependents. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. The IRS extended its safe-harbor relief from recognizing cancellation-of-debt COD income for students whose loans were discharged either because their schools were closed or as a result of some type of fraud Rev.

Ad Use our tax forgiveness calculator to estimate potential relief available. Submitted an application to the MHEC by September 15 2019. The IRS announced an expansion of relief to additional individuals who borrowed funds to attend school and later had that debt cancelled in Revenue Procedure 2020-11.

2 days agoThat number adds to an already robust 25 billion in student loan relief under Biden. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate.

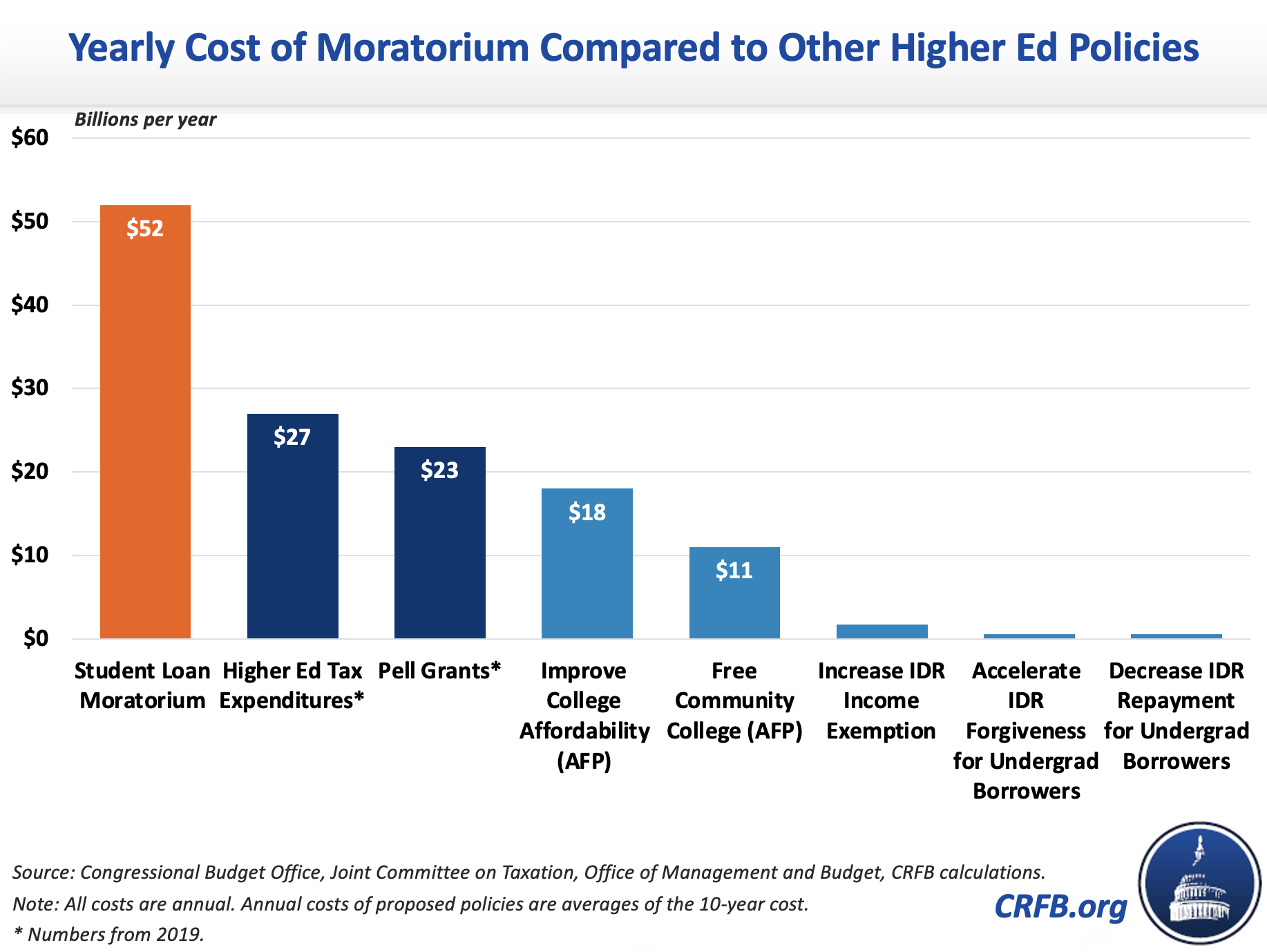

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Student Loan Forgiveness Statistics 2022 Pslf Data

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

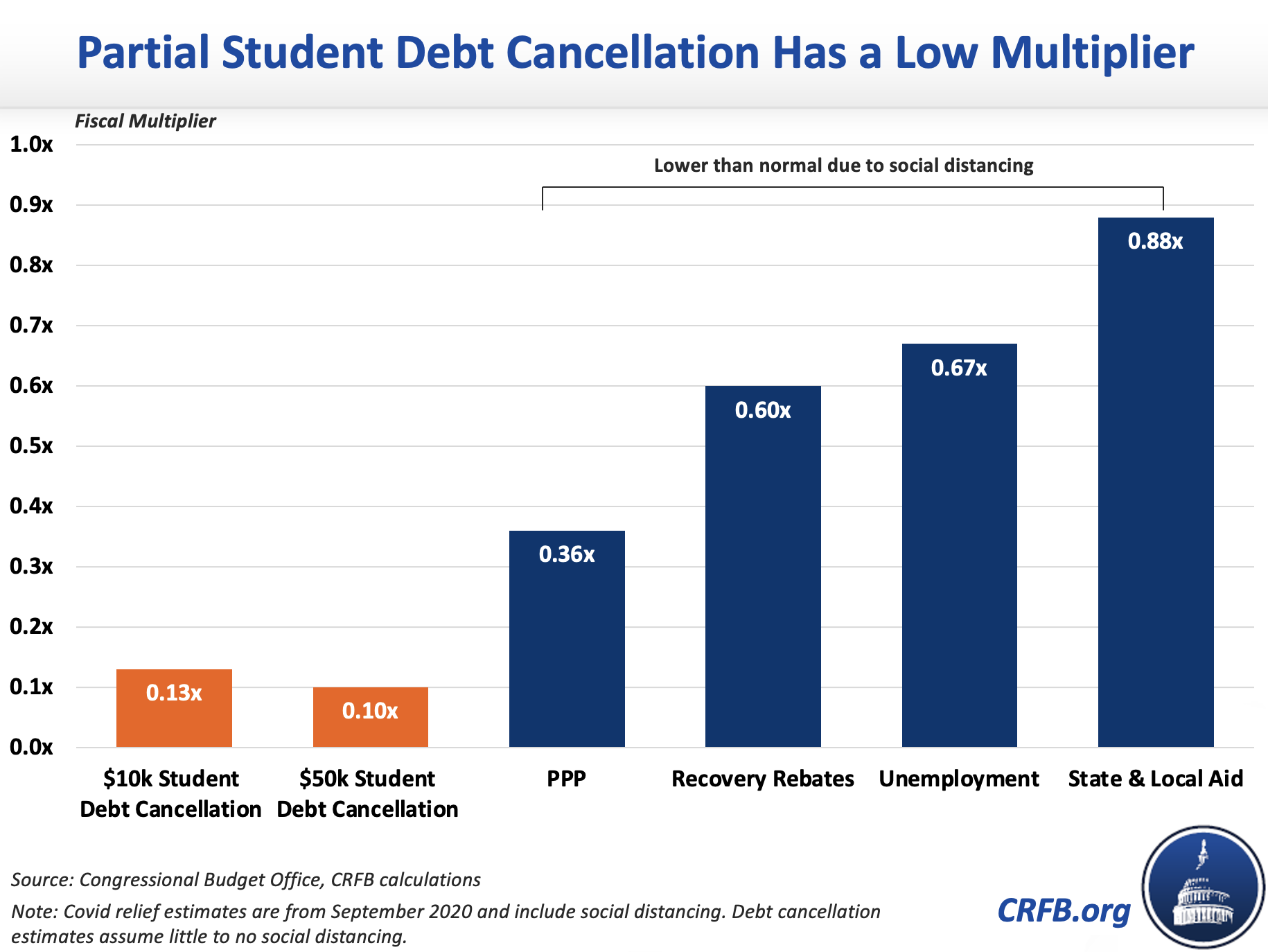

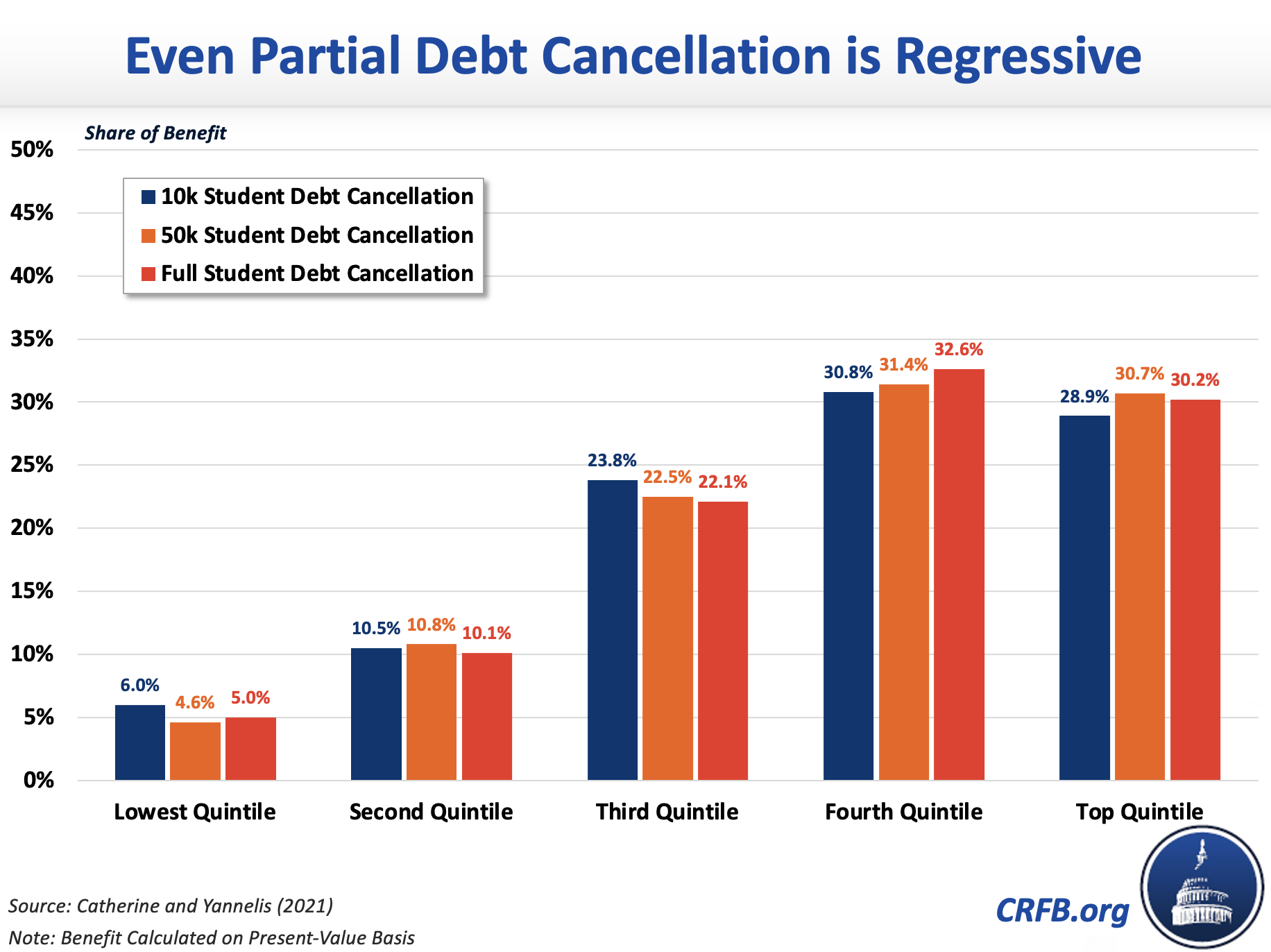

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Who Owes The Most In Student Loans New Data From The Fed

Can I Get A Student Loan Tax Deduction The Turbotax Blog

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero

Student Loan Debt Relief Options When Forbearance Ends Credit Karma

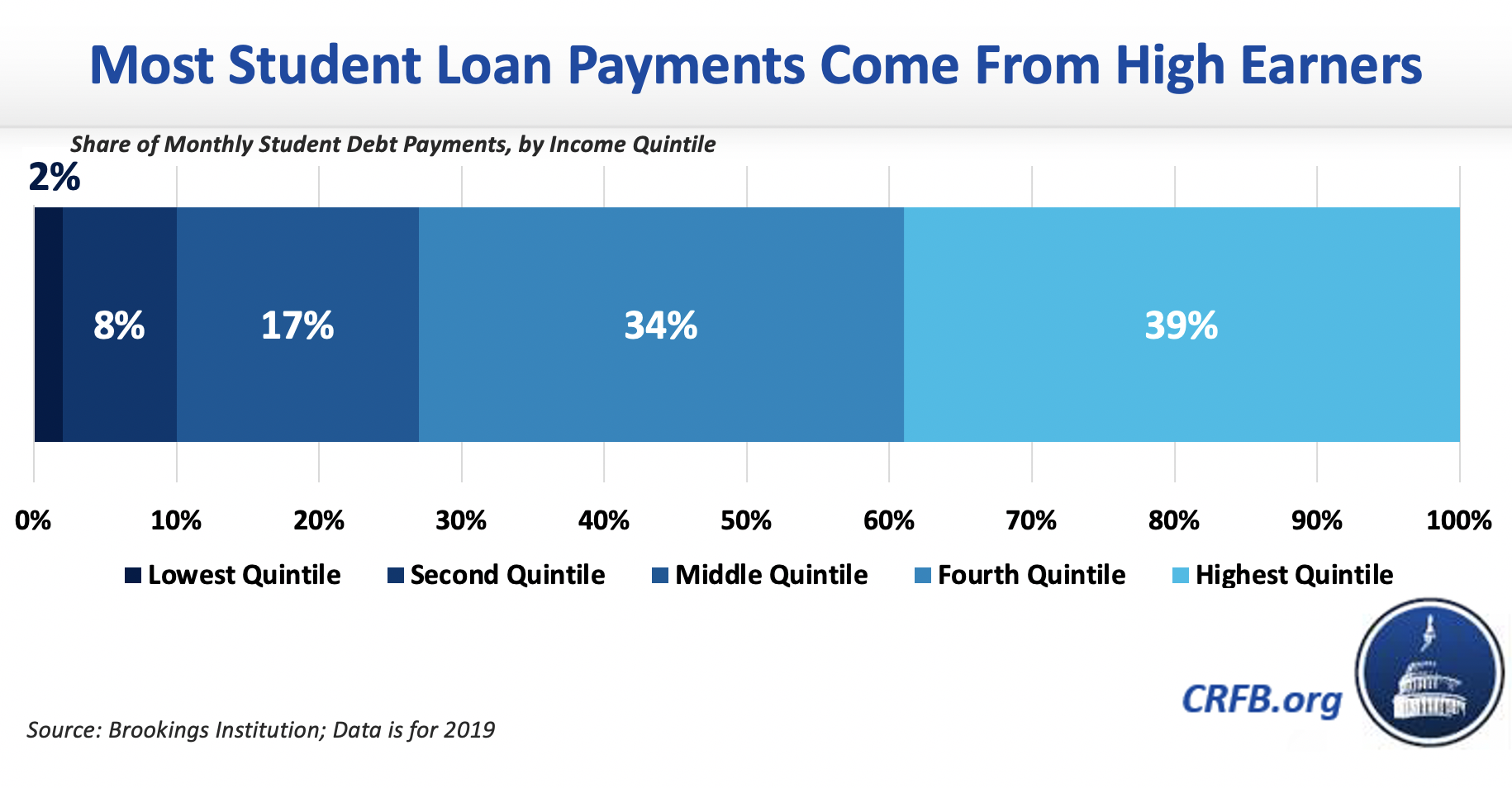

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Busting Myths On Student Loan Forgiveness Debate Student Loan Hero

Can I Get A Student Loan Tax Deduction The Turbotax Blog

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Chart Americans Owe 1 75 Trillion In Student Debt Statista

Coronavirus Student Loan Payment And Debt Relief Options Credit Karma

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget